Best Trading Apps in UAE

Discover the top trading platforms available in the United Arab Emirates in 2025

Explore Platforms

Discover the top trading platforms available in the United Arab Emirates in 2025

Explore Platforms

The United Arab Emirates has emerged as a major financial hub with a growing market for online trading platforms. With a robust regulatory framework and increasing digital adoption, trading apps have become essential tools for investors in the region.

The UAE trading market has seen significant growth, with increasing interest from both local and international investors.

Trading platforms in the UAE are governed by strict regulatory standards to ensure security and transparency.

With high smartphone penetration rates, mobile trading apps have become the preferred choice for many UAE investors.

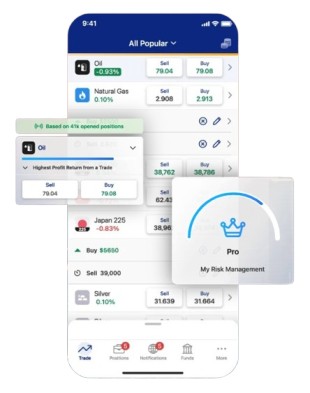

eToro is a leading social trading platform available in the UAE, regulated by the Abu Dhabi Global Market's Financial Services Regulatory Authority. It offers a user-friendly interface with innovative features like copy trading.

$100

ADGM FSRA

0% commission on stocks

Plus500 is a globally recognized trading platform that provides UAE traders with access to CFDs on a wide range of financial instruments. The platform is known for its user-friendly interface and robust trading tools.

$100

SCA (UAE), CySEC, FCA

2,800+ CFDs

XTB is a global fintech company that provides individual investors with instant access to financial markets worldwide. Its award-winning mobile app offers a comprehensive trading experience for UAE investors.

No Minimum

CySEC, KNF

5,000+ instruments

SaxoTraderGO is an intuitive web-based platform designed for retail investors and traders. It offers real-time market data, interactive charts, and sophisticated tools, making it a popular choice for UAE investors.

$2,000

Multiple global licenses

24/5 multilingual

Trading 212 offers commission-free investing with a user-friendly platform. UAE investors appreciate its fractional shares feature, daily interest, and comprehensive demo account options.

No Minimum

FCA, FSC

Very High

Sarwa is a financial platform and app that lets UAE residents easily trade stocks and ETFs, save and invest money passively all in one place. It's particularly popular among beginner investors in the UAE.

$1

DFSA

Invest, Trade, Save

Emirates NBD Securities offers a comprehensive trading platform for UAE residents, with access to local and international markets. As part of a major UAE bank, it provides seamless integration with banking services.

Local & International Markets

SCA

Available

AvaTrade is a globally recognized broker offering trading services to UAE residents. Known for its award-winning platform and comprehensive educational resources, it's a popular choice among UAE traders.

$100

Multiple global licenses

1,000+ markets

HSBC UAE WorldTrader is a comprehensive trading platform that gives UAE residents access to global markets. It offers competitive trading fees and a diverse range of investment options.

HSBC account holder

25 markets

Stocks, ETFs, Bonds

IQ Option is a popular trading platform that accepts traders from the UAE. It offers a user-friendly interface and a wide range of trading instruments, making it accessible for beginners and experienced traders alike.

$10

Accepts UAE traders

Available

BingX is a cryptocurrency exchange and social trading platform that has expanded into the MENA region, including the UAE. It offers various services including spot trading, derivatives, copy trading, and grid trading.

Cryptocurrencies

Spot, Derivatives, Copy

Zero fees

| Platform | Minimum Deposit | Regulation | Trading Fees | Assets | Mobile App | Best For |

|---|---|---|---|---|---|---|

| eToro | $100 | ADGM FSRA | 0% commission on stocks, spreads on other assets | Stocks, ETFs, Crypto, Forex, Commodities | Social Trading | |

| Plus500 | $100 | SCA (UAE), CySEC, FCA | Spreads only | 2,800+ CFDs | CFD Trading | |

| XTB | No Minimum | CySEC, KNF | Low commissions | 5,000+ instruments | Professional Traders | |

| SaxoTraderGO | $2,000 | Multiple global licenses | Commission-based | 70,000+ instruments | High-Net-Worth Investors | |

| Trading 212 | No Minimum | FCA, FSC | 0% commission on stocks and ETFs | Stocks, ETFs, CFDs | Beginners | |

| Sarwa | $1 | DFSA | $1 or 0.25% of traded value | Stocks, ETFs, Crypto | UAE Residents | |

| Emirates NBD | Varies | SCA | Varies | Stocks, ETFs, Bonds | UAE Bank Customers | |

| AvaTrade | $100 | Multiple global licenses | Spreads only | 1,000+ markets | Forex Traders | |

| HSBC WorldTrader | For HSBC customers | Multiple global licenses | Competitive fees | Stocks, ETFs, Bonds | HSBC Customers | |

| IQ Option | $10 | CySEC | Varies by instrument | Forex, Stocks, Crypto, Options | Low Budget Traders | |

| BingX | No Minimum | Multiple licenses | Varies | 750+ cryptocurrencies | Crypto Traders |

Understanding the regulatory landscape is crucial for traders in the UAE. Here's what you need to know about the legal requirements and regulatory bodies overseeing trading activities.

The SCA is the federal regulator overseeing securities and commodities markets in the UAE. It regulates trading platforms, brokers, and market activities to ensure fairness, transparency, and investor protection.

The DFSA regulates financial services conducted in or from the Dubai International Financial Centre (DIFC). Trading platforms operating within the DIFC must comply with DFSA regulations.

The FSRA is the regulatory body of Abu Dhabi Global Market (ADGM). It oversees financial services entities operating within the ADGM jurisdiction, including trading platforms.

The Central Bank regulates banking operations and certain financial activities, which may include aspects of trading platforms that involve banking services.

Proper Licensing

Trading platforms must obtain appropriate licenses from relevant regulatory bodies (SCA, DFSA, or FSRA) based on their operational jurisdiction within the UAE.

Capital Requirements

Platforms must maintain minimum capital requirements to ensure financial stability and protect investor assets.

KYC and AML Compliance

Strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures must be implemented to verify user identities and prevent fraudulent activities.

Data Protection

Trading platforms must comply with UAE data protection laws, ensuring secure handling and storage of user information.

Risk Disclosure

Platforms must provide clear risk disclosures to users, highlighting the potential risks associated with trading activities.

Transaction Reporting

Regular reporting of trading activities and transactions to regulatory authorities is required for transparency and monitoring purposes.

Several trading apps are legally operating in the UAE, including eToro, Plus500, XTB, SaxoTraderGO, Sarwa, Emirates NBD Securities, and HSBC WorldTrader. These platforms are either regulated by UAE authorities like the SCA, DFSA, or FSRA, or they operate under international regulations and accept UAE clients.

To start trading in the UAE, you need to:

The most trusted trading apps in the UAE are typically those with proper regulation and a strong reputation. eToro, regulated by ADGM FSRA, is highly trusted for its social trading features. SaxoTraderGO is preferred by professional traders for its comprehensive tools. Emirates NBD Securities offers the security of being backed by a major UAE bank. The "most trusted" app depends on your specific trading needs and preferences.

The best trading business in the UAE varies based on your trading goals:

Yes, stock trading is completely legal in the UAE for both citizens and residents. The UAE has established stock exchanges like the Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX), which are regulated by the Securities and Commodities Authority (SCA). International stock trading through regulated brokers is also legal.

To start trading in the UAE, you typically need:

Have questions about trading apps in UAE? Contact us for personalized recommendations or assistance.

Get the latest updates on trading platforms, market insights, and investment opportunities in the UAE.